In fintech, we talk endlessly about innovation. Yet, too often, we treat user experience as an afterthought. We obsess over compliance, security, and infrastructure, but forget the human at the centre of it all. And in doing so, we miss the most powerful signal users seek: “I understand this. I trust this. I’ll use it again.”

Across seven years in fintech, launching products in both frontiers and developed markets, I’ve seen one pattern repeat: step by step, trust builds up when UX works. When it doesn’t, even the best-engineered product struggles to find traction. What good is your payments engine if users don’t know where their money is? What’s the point of a beautifully designed dashboard if users feel out of their depth navigating it?

Too many enterprises still treat UX as mere polish, rather than what it truly is: a system for delivering clarity, confidence, and control. For everyone, it’s how trust is built or lost. We must treat UX as the front line of trust. Flows should be effortless for beginners, fast for experts, and calming for everyone. This is precisely why it is critical to anticipate confusion, and design to pre-empt doubt.

Emotionally aware error messaging leads to higher task success and stronger retention (Vasquez and San-Jose, 2024). Users who feel understood remain engaged. And engagement, over time, compounds into loyalty.

Your interface copy deserves the same strategic rigour as your product roadmap. Every alert, every modal, every “something went wrong” is a chance to build—or lose—trust. Clarity scales from policy to product. It moves beyond compliance and becomes a tool for loyalty. It transforms cold transactions into trusted relationships. And it shifts the narrative from “How secure is this app?” to “This app makes me feel secure.”

Transparent pricing = confident decisions

No one wants to be surprised by a hidden charge or a last-minute service adjustment. These moments irreversibly erode trust. 39% of consumers have walked away from a brand due to unexpected fees (Deloitte, 2021).

Wise understands this. Before you send money, you see everything: how much it costs, what the recipient will receive, and the current exchange rate. It’s all laid out clearly, before you commit.

And this approach should apply across the board: subscriptions, transfers, loans, and service tiers. If your product has cost layers, break them down. Display them early. Let users see the value and make informed decisions.

If low fees are part of your promise, prove it where it counts. Like inDrive, which uses low fees as a competitive advantage: by displaying the fee details right on the wallet screen, the app turns pricing transparency into a strategic asset, helping drivers stay focused on what matters most—their earnings.

Stop hiding. Start showing. Treat every price tag like part of the product experience. Because it is.

Reinforce the success of the customer’s actions

Uncertainty is the enemy of trust. When users complete a transaction—send money, approve a payment, move funds—they need immediate confirmation that the system has done its job. A simple message like “$45 sent to Sofia” delivers more than a receipt. It delivers reassurance. It turns a moment of potential doubt into one of control.

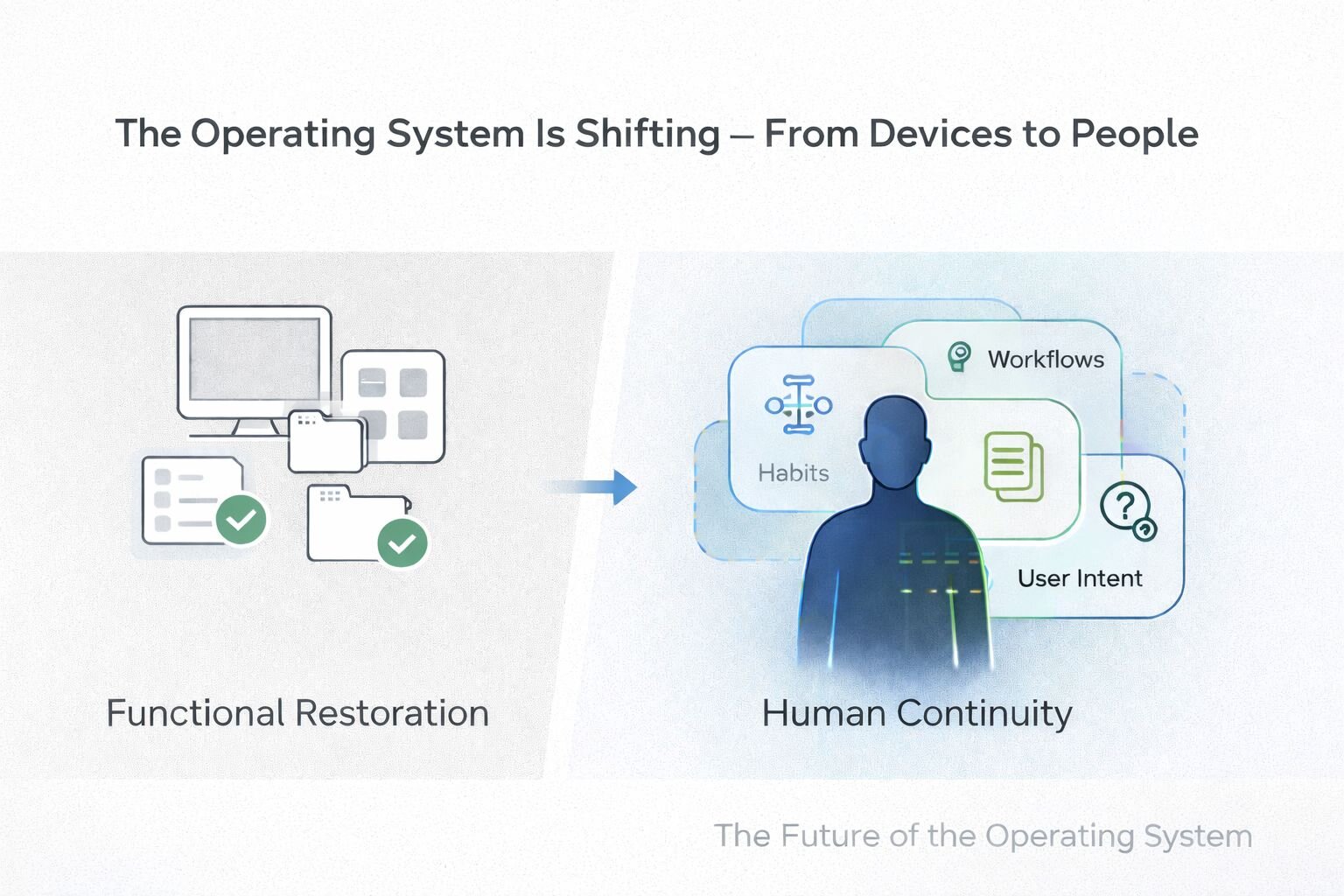

An even better idea is to add visual and tactile cues (e.g., a green checkmark, a brief animation, or subtle haptic feedback), which creates a satisfying, almost visceral closure. These micro-rewards matter. Neurologically, they release dopamine, anchoring the experience as safe, complete, and repeatable. This is how habits are formed and loyalty is built, not through logic but through emotional resolution.

Keep users informed without overwhelming

But feedback shouldn’t end at success states. Communication must continue, especially when users manage something as sensitive and personal as money (Runsewe et al., 2022). Push notifications, banners, and in-app alerts should work in harmony to keep users informed about billing cycles, security updates, new features, and regulatory changes.

For consumer apps, this might mean a gentle heads-up about an upcoming debit or a new savings tool. For B2B platforms, it could mean surfacing real-time compliance alerts or notifying finance teams of updated payout timelines. In both cases, relevance and tone matter. No one wants noise, but everyone appreciates timely, actionable signals.

Pre-fill whenever possible and reduce input

Nothing breaks momentum faster than being asked to retype information that a product should already know. If you’ve seen my name, email, and card details before, why do I need to enter them again? Every repeated step signals that the product isn’t listening.

Start by trimming the excess. Hide optional fields unless they serve a clear purpose. Show only what’s essential to keep the flow moving. Then, go further and pre-fill where possible. If a user enters the same top-up amount every week, offer it first. If they always pay with the same card, make it the default. In one top-up experience I designed, simply pre-filling frequent amounts nudged users forward—with a 2% lift in conversion achieved with just a small redesign that focused on relevance and user needs.

Eliminate typing wherever possible. Instead of blank fields, give users selection lists or smart suggestions based on their past behaviour. You’re both saving time and reducing risks. Every manual entry is a chance to mistype a digit, miss a detail, or misroute money. This is why manual input remains one of the most persistent frictions. In one B2B finance product I worked on, mobile adoption lagged because business owners feared getting things wrong—preferring the perceived safety of the desktop, even when mobile could have been faster. Their hesitation wasn’t due to the platform. It was due to doubt.

When users see the system remembering what they do, they feel seen, understood, and in control. And that’s where product loyalty begins, not with what you ask but with what you already know.

Automatically format data to create clear outcomes

Typing out a long bank account number shouldn’t feel like threading a needle in the dark. But for many users, that’s precisely the experience—one continuous string of digits, no visual structure, and high stakes if something goes wrong.

That’s where automatic formatting does its real work. When users enter an IBAN, don’t wait until they press submit to clean things up. Format it live. If you’re handling Spanish accounts, pre-fill “ES00 0000 0000 00 000000000,” then guide the input visually by adding spaces, enforcing character limits, and validating the structure as they go. These small cues bring rhythm to an otherwise stressful task.

Better still, use that input to identify the bank in real time. If a valid IBAN is associated with CaixaBank, inform the user. It’s a reassuring moment: they see the system responding intelligently, reflecting their intent, and catching mistakes before they happen.

The three main lessons to take away about UX design for fintechs

UX design for fintech involves designing for one of the most sensitive and high-stakes areas of a user’s life. People don’t come to your product looking to be dazzled. They come looking to feel safe. In control. Respected.

You’re not just creating a flow for sending money or viewing transactions. You’re shaping how someone experiences risk, confidence, and clarity, all in real time.

To do that well, build around these three unshakable principles:

Transparency: Say what you mean. Show what it costs.

Users don’t fear fees. They fear not knowing when they’ll show up. Strip away fine print. Give real numbers in real time. Clear information builds trust faster than any feature.

Security: Show users you’ve thought of everything so they don’t have to.

Trust isn’t earned with encryption alone. It comes from signals: confirmations that land instantly, guardrails that make smart assumptions, and the quiet calm of a product that just works, even in moments of tension.

Automation: Make the obvious path effortless.

Repetition is friction, but anticipation is magic. Every time your product pre-fills a field, suggests a frequent action, or streamlines a complex task, it’s telling the user: 'We've seen this before, we’ve got you.'

Final thoughts

When these three elements work together, the result is something more powerful than usability, which is built—or broken—in the smallest moments.

Start by choosing one part of your product where uncertainty still lingers. Select a key moment in your workflow, such as onboarding, payments, or a declined transaction. Where does clarity slip? Where does doubt creep in? Improve one thing this week that makes trust visible.

And if you’re working through these questions yourself, I’d love to connect. Find me on LinkedIn.