One Tuesday morning, I walked into a “go/no-go” launch meeting feeling confident, until the CFO asked a single question that collapsed my roadmap like a Jenga tower:

“How does this feature move net-revenue retention this quarter?”

My deck sang about user delight; her P&L demanded cash this fiscal year. I froze. My carefully crafted roadmap suddenly looked like a wishlist disconnected from reality. Engineers shifted in their seats, design leads frowned, and I realized the credibility of the product team was slipping away in real time.

That moment crystallized a truth every product manager eventually faces:

Vision isn’t vision until it’s shared.

The best product strategies live in the alignment between product managers and executives. This post distills the frameworks, stories, and playbooks I’ve used to turn vision clashes into executive handshakes you can bank on.

Why executive alignment matters in product management

Alignment is the difference between teams that accelerate and teams that stall.

- Speed to value – Misalignment balloons cycle times and erodes focus. A PM chasing adoption while Sales is chasing upsell can lose quarters debating priorities instead of shipping.

- Resource efficiency – When roadmaps pivot mid-stream, sunk costs spike. One team I worked with had to abandon three sprints of work when the CFO pulled funding because the revenue model wasn’t aligned.

- Credibility – Teams trust PMs who speak both customer love and commercial logic. If executives see you as the translator between user needs and business outcomes, they back your bets.

- Optionality – A shared vision secures latitude for bold bets. When leadership trusts you, they’ll give you cover to experiment, even when outcomes are uncertain.

Alignment means a commitment to shared outcomes, even when paths diverge.

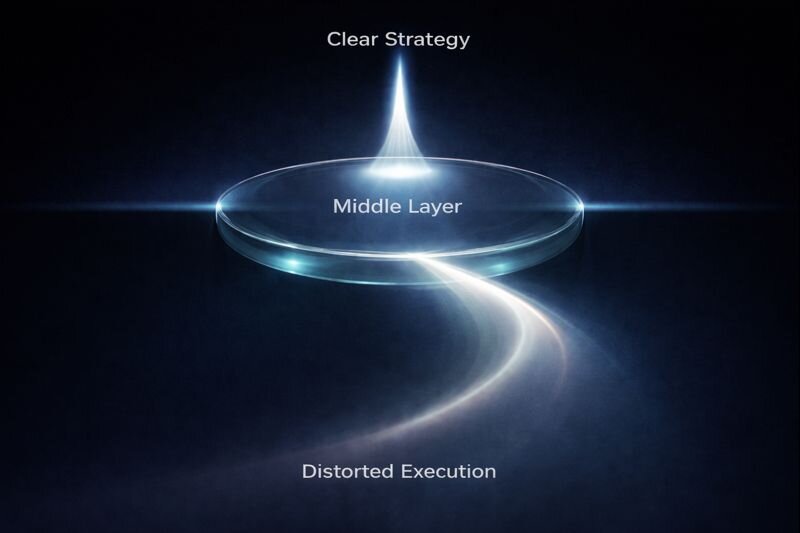

Diagnose the gap: four common misalignments

Every vision clash falls into one of four buckets:

- Goals misalignment – Different definitions of success (e.g., “expand NRR” vs. “grow MAUs”).

- Beliefs misalignment – Divergent views on how the market works (e.g., “enterprise-first” vs. “PLG-first”).

- Timeline misalignment – Horizon conflict (quarterly revenue vs. a 12–18-month platform play).

- Risk-appetite misalignment – Variance tolerance around regulation, brand exposure, or infra stability.

Quick audit checklist

- Does your North-Star Metric echo this year’s board target?

- Can every exec recite why users switch to your product?

- Are roadmap items bucketed by horizon (Now / Next / Later)?

- Have you codified “red-line” risks and evidence gates?

Most alignment breakdowns aren’t about the roadmap itself. They’re about hidden assumptions in one of these categories.

The alignment framework

1. Run a decision-journal workshop

A Decision-Journal Workshop is a two-hour, cross-functional session held after discovery but before the first sprint.

Step 1: List assumptions powering the roadmap item.

Example: “Users will share files externally at least twice a week.”

Step 2: Record the evidence level (anecdote, survey, cohort data, pilot).

Step 3: Brainstorm at least two alternative paths to achieve the same outcome with fewer irreversibles.

E.g., API integration instead of native build; manual concierge before automation.

Step 4: Define kill criteria - thresholds that trigger a stop or pivot.

Example: “If fewer than 20% of trial accounts activate sharing within 14 days, halt build and redirect capacity.”

Step 5: Capture and share - post the journal in your team’s channel or wiki.

This artefact prevents revisionist history, accelerates “yes/no” calls, and builds executive confidence.

In one enterprise rollout, this method saved six months of wasted engineering. We had assumed compliance sign-off would be easy, but when Legal pushed back, the kill criteria kicked in early, letting us pivot before sunk costs ballooned. In startups, the same process is lighter weight but just as powerful, giving founders and PMs clarity on when to push and when to pull back.

2. Master storytelling for influence

Data persuades, but stories move decisions. The best executive updates follow a Context → Conflict → Resolution → Evidence arc.

- Context: Frame the landscape - market shift, customer pain, or competitive threat.

- Conflict: Spotlight the obstacle or trade-off creating urgency.

- Resolution: Present your decisive product action, linking roadmap bets to executive priorities.

- Evidence: Seal credibility with one high-signal metric or a customer quote -reinforced by a single compelling visual.

Consider two updates:

Bad: “We built three new features last sprint. Adoption looks okay. Next, we’re working on X.”

Good: “Competitors are undercutting us with a freemium tier (Context). Our growth funnel is leaking trial users at week two (Conflict). We’re launching usage-based nudges to improve trial-to-paid conversion (Resolution). In pilots, conversion rose 14% (Evidence).”

The second update doesn’t just inform, it aligns execs emotionally and logically with your decision.

When visions diverge: playbooks for four scenarios

Even with the best prep, product and business visions will diverge. The key is not to “win” the argument but to reframe the conversation around shared outcomes. Here are four common scenarios and how to handle them:

Case A: Same goal, different path

- The clash: Everyone agrees on the destination (e.g., expand NRR), but leaders disagree on the route. Marketing wants a paid referral program; Sales prefers bundling features for enterprise deals.

- The risk: Endless debate delays progress, while both sides believe their path is “obvious.”

- Actionable move: Use a Strategy Cascade and Assumption Map to make trade-offs explicit. Then, propose a short pathfinder experiment (4–6 weeks) to test the cheaper/faster option.

- Example: At one SaaS company, Marketing pushed for a costly brand campaign. Instead, the team ran a two-week pilot with targeted LinkedIn ads. Early data showed low CAC efficiency, which gave Sales the evidence to double down on enterprise upsell instead, saving six figures.

Case B: Different goals / NSM conflict

- The clash: Two executives anchor on different success metrics. Product is chasing MAUs; the CFO wants NRR this quarter.

- The risk: Roadmap debates devolve into a tug-of-war because you’re solving for different outcomes.

- Actionable move: Elevate to a portfolio-level conversation. Map each initiative against NPV × strategic-fit × risk. Then apply a 70/20/10 allocation (core, adjacent, new bets) to distribute effort fairly.

- Example: In one org, Product wanted to build a free tier for adoption, while Finance prioritized a pricing uplift. By plotting both bets on the matrix, leadership agreed on 70% effort toward upsell features, 20% on the freemium experiment, and 10% for moonshots. Both sides saw their goals represented without derailing focus.

Case C: Horizon mismatch

- The clash: Executives argue over time horizons. The CEO pushes for a 12–18 month platform play; the CRO needs revenue this quarter.

- The risk: Long-term bets starve short-term cash flow, or near-term sprints crowd out foundational work.

- Actionable move: Run dual tracks: one Now track for near-term wins, and one Next track for longer-term strategy. Use a dependency map to show how today’s work unlocks tomorrow’s value.

- Example: At a fintech startup, the team built a lightweight loan calculator (Now track) to drive sign-ups while simultaneously investing in the core risk-scoring engine (Next track). Showing how the calculator fed data into the engine made the CRO and CEO feel equally invested.

Case D: Risk-appetite mismatch

- The clash: Teams disagree on how much uncertainty is acceptable. Product wants to launch an experimental AI feature; Legal worries about compliance exposure.

- The risk: Progress stalls because leaders see risk through different lenses.

- Actionable move: Add an Incremental-Transformational slider to every initiative. Then bundle evidence gates (clear checkpoints) and stopping rules so leaders know how uncertainty will shrink.

- Example: At an e-commerce company, the PM proposed AI-generated product descriptions. Legal balked. The compromise: start with a low-risk subset (internal categories only), measure accuracy vs. human copywriters (evidence gate), and agree to pause if error rates exceed 5%. This lets the team test innovation without blowing trust.

Conclusion & key takeaways

If you remember just three things:

- Run decision-journal workshops to anchor assumptions, alternatives, and kill criteria.

- Tell stories: Context → Conflict → Resolution → Evidence.

- Visualize trade-offs with matrices, sliders, and dual tracks to turn clashes into consensus.

Alignment is a practice of continuous calibration. PMs who master it build credibility and trust and influence that compound over time.

When vision meets evidence, and stories meet numbers, you can win trust that lasts beyond the next quarter.